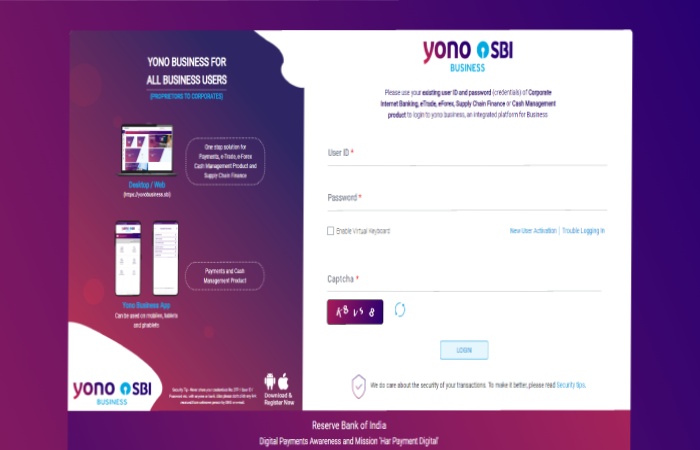

YONO Business is a specific version of the YONO app tailored for business customers. It offers various features and functionalities to help business owners conveniently manage their finances and banking needs.

The Features and Functionalities of YONO Business

Account Management

Business owners can open and manage their accounts through the YONO Business platform. They can view account balances and transaction history and generate account statements.

Payments and Transfers

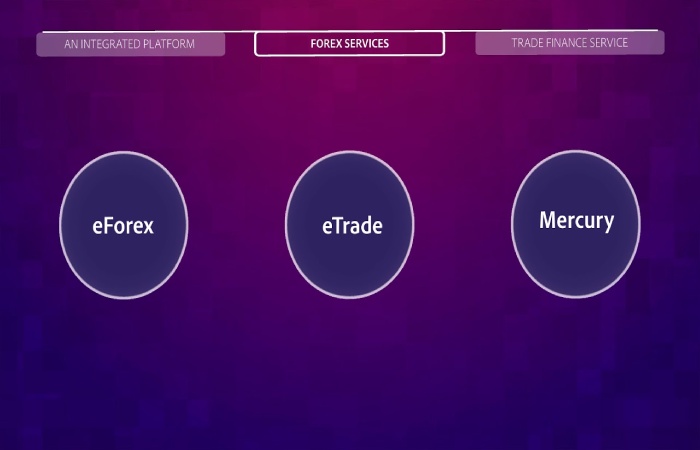

YONO Business allows users to initiate fund transfers between accounts within SBI and to other banks using NEFT (National Electronic Funds Transfer), RTGS (Real Time Gross Settlement), and IMPS (Immediate Payment Service). It also supports bill payments, including utilities, taxes, and invoices.

Online Banking Services

The platform provides online banking services, such as applying for loans, credit cards, and overdraft facilities. Users can also request chequebooks, stop cheque payments, and update their contact information.

Investment and Insurance

YONO Business offers investment options such as fixed deposits, mutual funds, and government schemes. Additionally, users can access insurance products like life insurance, health insurance, and general insurance policies.

Analytics and Reports

Business owners can access financial analytics and reports within the YONO Business app. These insights help them track their business performance, monitor cash flows, and make informed financial decisions.

Merchant Services

YONO Business enables businesses to accept customer payments using modes such as UPI (Unified Payments Interface), QR codes, and cards. It helps streamline the payment collection process and provides transaction-related details.

Digital Documents

YONO Business allows users to store and manage critical business documents digitally, reducing the need for physical paperwork. This feature offers convenience and accessibility to essential documents anytime, anywhere.

Note: It’s important to note that the features and functionalities of YONO Business may vary based on the specific banking regulations and services provided by the State Bank of India.

YONO Business, the business-focused version of the YONO app provided by the SBI (State Bank of India), offers several benefits for business owners. Here are some of the critical advantages of using YONO Business:

Understanding Yono Business and its Benefits

Overall, YONO Business offers business owners a comprehensive and user-friendly digital banking experience. It combines convenience, accessibility, and a wide range of financial services to streamline banking operations and support the growth and management of businesses.

Convenience

YONO Business provides a one-stop solution for managing various banking and financial needs. Business holders can access a wide range of services and perform transactions conveniently from their mobile devices or computers, eliminating the need to visit a bank branch physically.

Time-saving

With YONO Business, business owners can save valuable time by performing banking transactions and accessing financial services digitally. It reduces the need for manual paperwork, long queues at the bank, and multiple visits for different banking tasks.

Accessibility

The YONO Business app offers 24/7 access to banking services, allowing business owners to manage their finances anytime and anywhere with an internet connection. This accessibility ensures that important banking tasks can be completed outside traditional banking hours.

Financial Management

YONO Business provides tools and features to help business owners efficiently manage their finances. They can view account balances, track transactions, and generate statements to monitor their cash flows effectively. The platform also offers financial analytics and reports, enabling users to gain insights into their business performance.

Payment Solutions

YONO Business supports various payment options, including NEFT, RTGS, IMPS, UPI, and card payments. Business owners can initiate fund transfers, make bill payments, and collect payments from customers seamlessly using digital payment methods. This facilitates faster and smoother transactions for business operations.

Investment Opportunities

YONO Business offers investment options such as fixed deposits, mutual funds, and government schemes. Business owners can explore these opportunities to grow their savings and earn returns on surplus funds. These investment options within the app simplify the process and save time compared to traditional investment methods.

Insurance Coverage

The platform also provides access to insurance products, including life insurance, health insurance, and also general insurance policies. Business owners can avail themselves of suitable coverage options to protect their business, assets, and employees, all through a single platform.

Document Management

YONO Business allows users to store and manage critical business documents digitally. This feature eliminates the need for physical paperwork, reduces the risk of document loss/damage, and provides easy access to essential documents whenever required.

Conclusion

In conclusion, YONO Business, the digital banking platform of the State Bank of India (SBI), offers numerous benefits for business owners. It provides a convenient and time-saving solution for managing banking and financial needs, allowing users to access a wide range of services anywhere at any time.

The platform simplifies financial management by providing features such as account management, payment solutions, investment opportunities, insurance coverage, and document management. With YONO Business, business owners can streamline their banking operations, gain valuable insights into their business performance, and save time by conducting transactions digitally. Overall, YONO Business empowers businesses with efficient and accessible banking services, contributing to their growth and success.